Estate Planning

Our Estate Planning service helps individuals and families protect their assets, ensure their wishes are fulfilled, and minimize tax burdens, all in compliance with state-specific probate and estate tax laws. We recognize that estate planning is deeply personal, and our approach is tailored to your unique family structure, assets, and goals—whether you’re looking to protect a family home, provide for minor children, or leave a legacy to charitable organizations.

Core services include will drafting, ensuring compliance with state execution requirements (e.g., witness signatures, notarization) and clearly outlining asset distribution, guardian appointments for minor children, and executor designations. We specialize in trust creation, including revocable living trusts (to avoid probate, maintain privacy, and streamline asset transfer), irrevocable trusts (for estate tax planning, asset protection from creditors, and Medicaid planning), and special needs trusts (to provide for disabled family members without jeopardizing government benefits).

We also prepare essential estate planning documents such as durable powers of attorney (authorizing a trusted individual to manage financial matters if you become incapacitated) and healthcare directives (including living wills, which outline your medical treatment preferences, and healthcare proxies, which appoint someone to make medical decisions on your behalf).

Our team provides probate administration support, guiding executors through the state-specific probate process—from filing the will with the probate court to inventorying assets, paying debts and taxes, and distributing assets to beneficiaries. We address state-specific considerations, such as Florida’s homestead exemption (protecting a primary residence from creditors and reducing estate tax liability) and Minnesota’s estate tax thresholds, ensuring that your estate plan is optimized for the state where you reside.

For Chinese-American families with cross-border assets, we provide specialized planning to address international estate tax issues, asset protection, and the transfer of assets between the U.S. and China. We also offer ongoing estate plan reviews and updates, ensuring that your plan remains current with major life changes (e.g., marriage, divorce, birth of children, acquisition of significant assets) and changes to federal or state estate tax laws.

Our goal is to provide peace of mind, knowing that your assets are protected, your loved ones are provided for, and your wishes will be carried out in accordance with U.S. law.

Immigration

Individual Tax

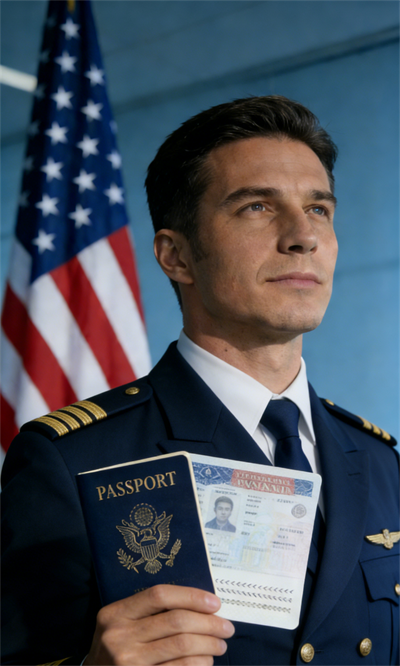

Pilot Immigration

Estate Planning