Individual Tax

Our Individual Tax service ensures full compliance with U.S. federal and state tax laws, delivering personalized strategies to minimize liability while adhering to IRS regulations and state tax codes. We serve a diverse client base—including U.S. citizens, green card holders, resident aliens, and non-resident aliens with U.S. income—with a focus on clarity and proactive planning.

Core services include federal and state tax return preparation, covering Form 1040 (U.S. Individual Income Tax Return) and state-specific forms (e.g., Florida’s Form F-1040, Minnesota’s Form M1), with meticulous attention to deductions, credits, and exemptions allowed under the Internal Revenue Code (IRC).

We specialize in cross-border tax compliance, assisting Chinese-American clients and foreign nationals with reporting foreign income, assets, and bank accounts in accordance with FATCA (Foreign Account Tax Compliance Act) and FBAR (Report of Foreign Bank and Financial Accounts) requirements. Our team provides guidance on claiming foreign tax credits to avoid double taxation, navigating the U.S.-China tax treaty, and determining residency status for tax purposes (e.g., the substantial presence test).

We also offer tax planning services, helping clients optimize their financial decisions to reduce tax liability—including retirement account contributions (401(k)s, IRAs), charitable giving, real estate tax strategies, and capital gains planning. For clients facing IRS audits or disputes, we provide audit defense, representing you in communications with the IRS, preparing documentation to support your tax return, and negotiating resolutions (e.g., offers in compromise, installment agreements) to minimize penalties and interest.

We also assist with tax debt resolution, helping clients address back taxes and navigate IRS collection processes. Our Enrolled Agents (EAs)—federally authorized tax practitioners with unlimited rights to represent clients before the IRS—bring specialized expertise in tax law and procedure, ensuring that every tax strategy is legally sound and tailored to your financial situation.

We prioritize transparency, explaining complex tax concepts in plain English (or Mandarin) and providing detailed breakdowns of your tax liability, deductions, and credits to help you make informed financial decisions.

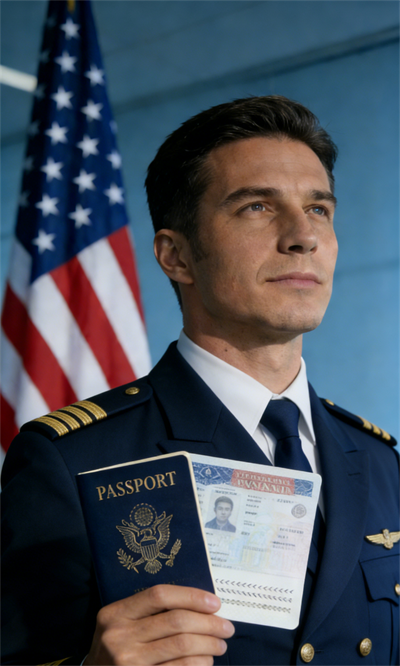

Immigration

Individual Tax

Pilot Immigration

Estate Planning